operating cash flow ratio negative

A negative cash flow margin is an indicator that the company is losing money. A good operating cash flow margin is typically above 50.

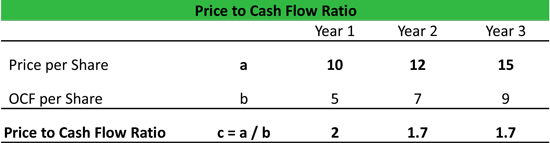

Price To Cash Flow Ratio Formula Example Calculation Analysis

When the ratio is low or negative it could be an indication that the company needs to adjust its operations and start figuring out which activities are sinking its income or whether it needs to expand its market share or increase sales in favor of revamping cash flows.

. But also remember negative cash flow or lower ratio always does not indicate poor performance it has happened due to company. Ultimately your business needs enough money to cover operating expenses. Negative operating cash flow is a situation in which a company or business does not have access to the necessary funds when they are needed to meet expenses.

Instead you need money from investments and financing to make up the difference. Negative OWC indicates that operating current assets are lower than operating current liabilities and this provides the business with access to free short-term funding. To investors and analysts a.

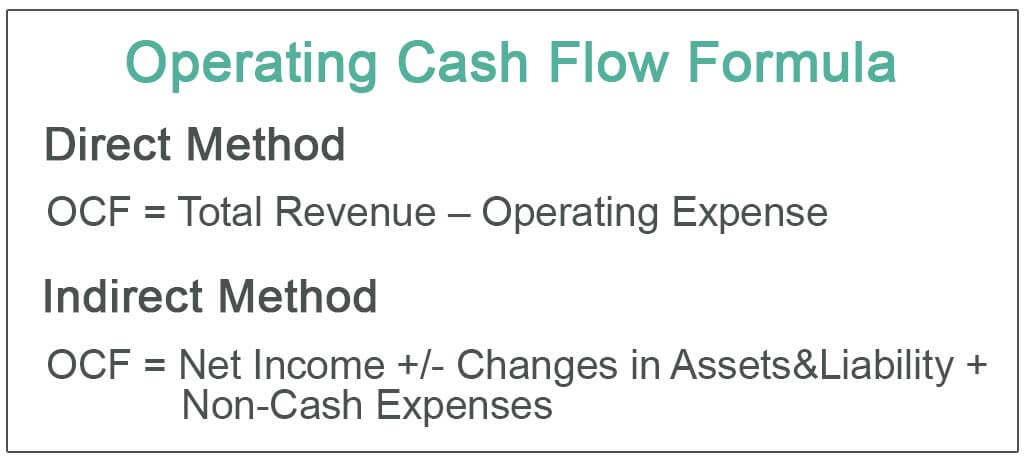

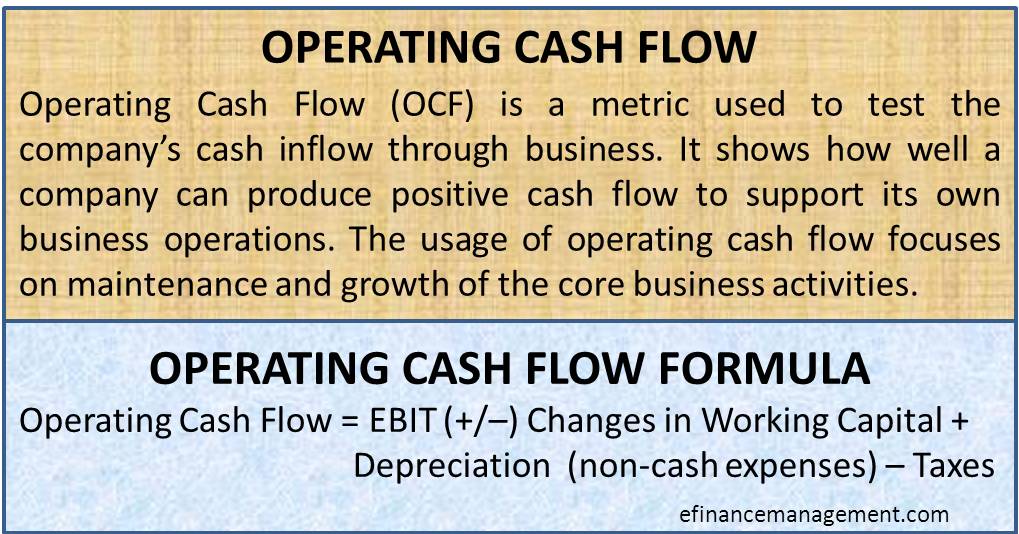

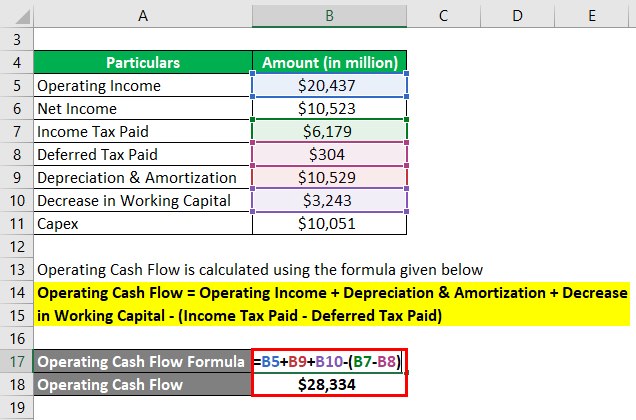

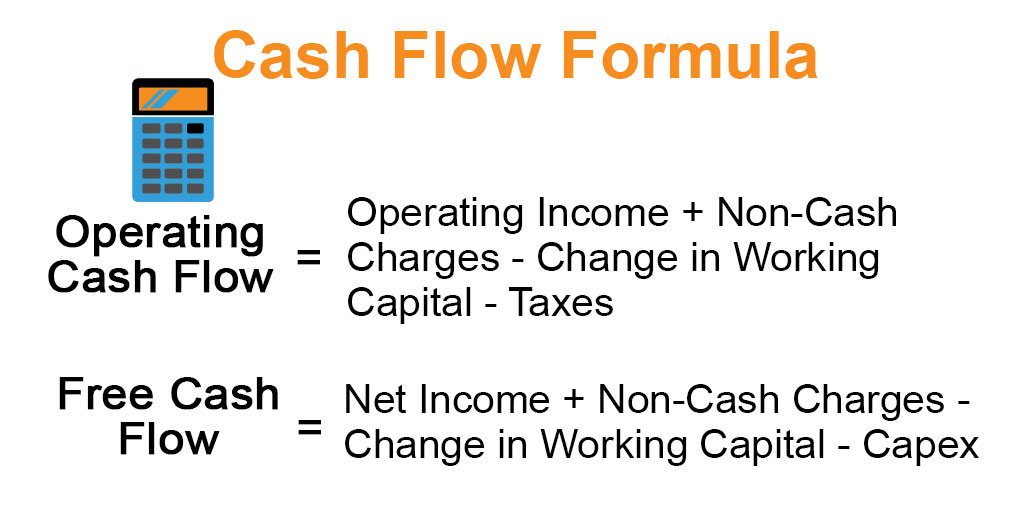

What does a negative cash flow margin mean. A negative cash flow can be used in the field of personal finance as well as corporate. The detailed operating cash flow formula is.

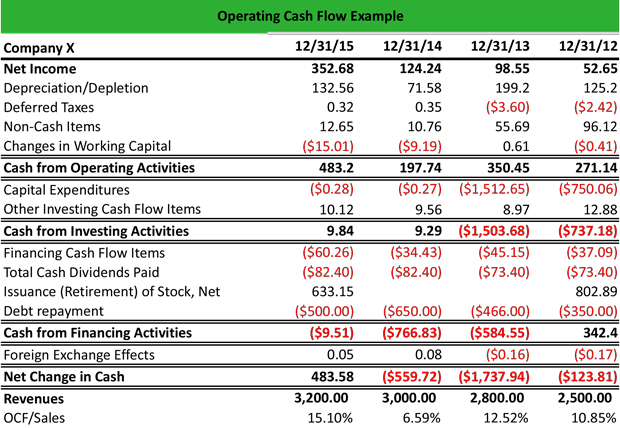

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. Dividing -50000 by 500000 to get -01 or -10. Free cash flow is the cash that a company generates from its business operations after subtracting.

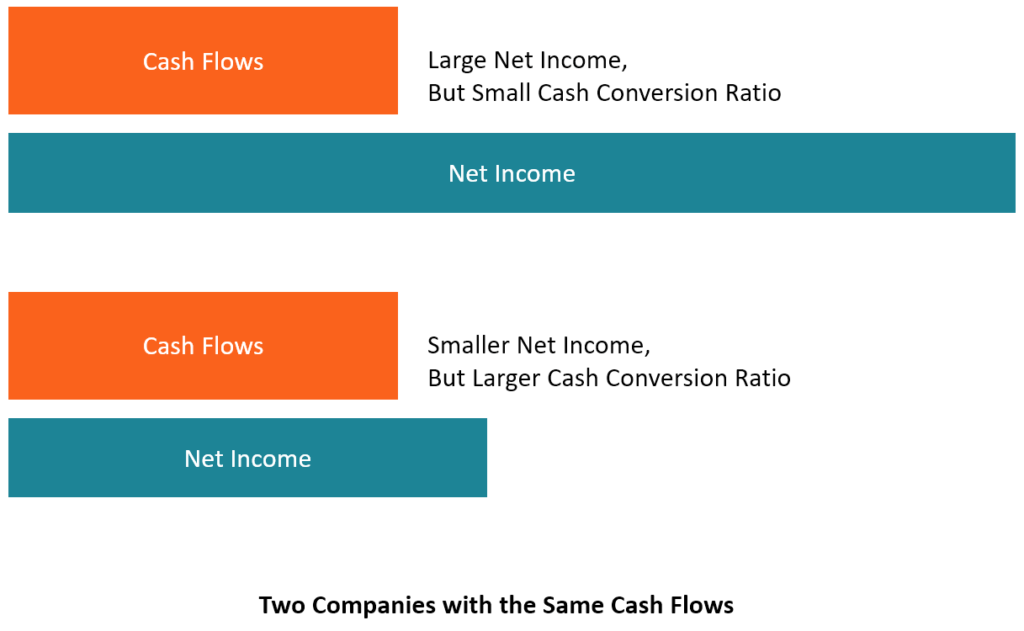

Cash Flow from Operations refers to the cash flow that the business generates through its operating activities. Two entirely different companies can prevail in very diverse circumstances especially when theyre not operating. Though negative cash flow is not inherently bad this financial asymmetry is not sustainable or viable for your business in most cases.

Operating Cash Flow - OCF. A growing company with positive operating working capital is more likely to have a cash conversion ratio below 10. Operating cash flow indicates whether a company is able to.

You cannot cover your expenses from sales alone. This number can be found on a companys cash flow statement. Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and income Deferred income taxes Increase in inventory Increase in accounts receivable Increase in accounts payable Increase in accrued expense Increase in unearned revenue.

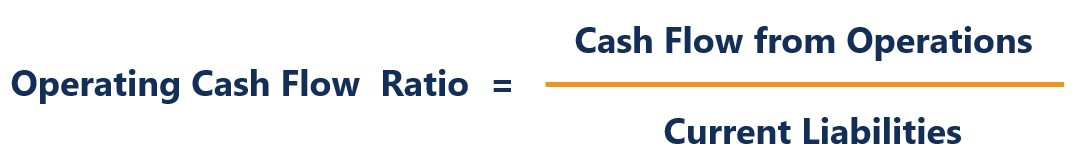

As mentioned before negative cash flow means that your business is spending more money than it receives. The two primary drivers for. An operating cash flow ratio of less than one indicates the oppositethe firm has not generated enough cash to cover its current liabilities.

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. The company is probably struggling if they have a negative operating cash flow. A negative operating cash flow can only occur due to negative earnings or a considerable increase in working capital during the given time period.

There is not one straightforward approach to assessing a business with negative CFO. The formula to calculate the ratio is as follows. On the other side if the operating cash flow ratio is lower than one means company cash flow is negative and the company needs to improve performance or increase its capital.

Negative cash flow is when your business has more outgoing than incoming money. We can see that net cash used in investing activities was -1859 billion for the period highlighted in green. In the second scenario above because the operating profit is negative the profit margin percentage will be negative.

When the outflow of cash is higher than the inflow of cash the firm enters a negative financial state. For example if you had 5000 in revenue and 10000 in expenses in April you had negative cash flow. Operating Cash Flow Margin.

Otherwise it will trap in debt in near future. If a company has an operating cash flow margin of below 50 this suggests that the company is not efficiently making sales into cash and instead may have high expenses. Operating cash flow measures cash generated by a companys business operations.

The operating cash flow can be found on the. Operating cash flow is a measure of the amount of cash generated by a companys normal business operations.

Negative Cash Flow Investments In Companies

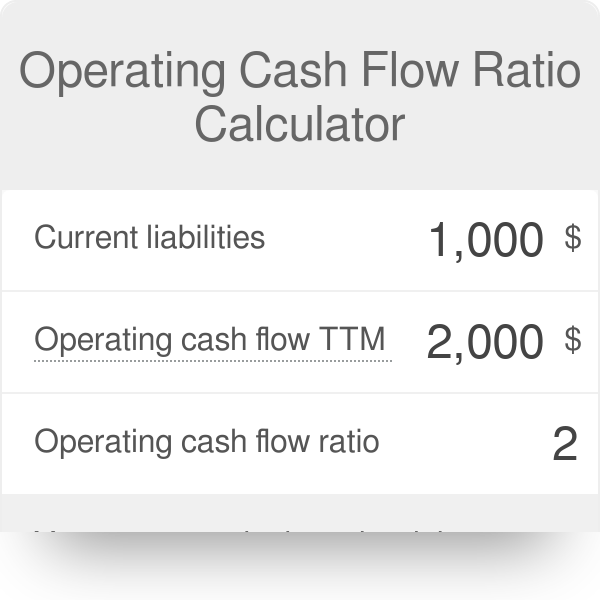

Operating Cash Flow Ratio Calculator

Operating Cash Flow Formula Calculation With Examples

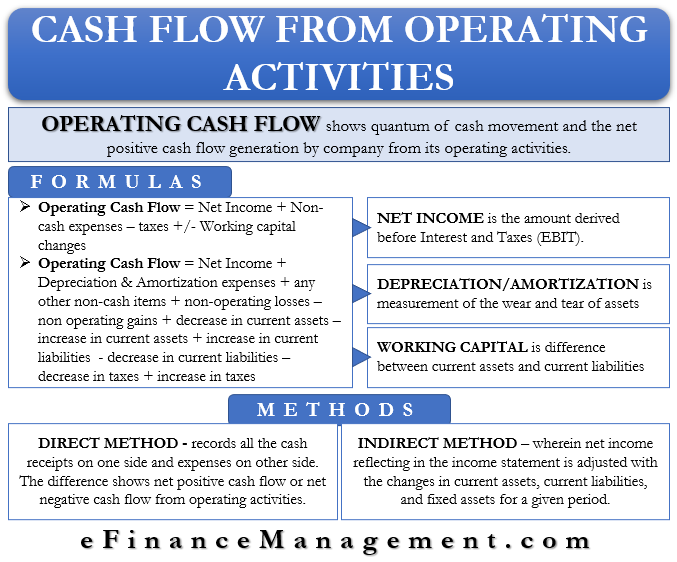

Cash Flow From Operating Activities Direct And Indirect Method Efm

Negative Cash Flow Investments In Companies

Cash Flow Statement Analysis Double Entry Bookkeeping

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

What Is Operating Cash Flow Ocf Definition Meaning Example

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Negative Cash Flow Investments In Companies

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Operating Cash Flow Efinancemanagement Com

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Ratio Definition And Meaning Capital Com